- 290.72 KB

- 2022-04-29 14:48:34 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

'Ch.3TheIncomeStatement主讲:郑炜玲厦门大学MBA中心2187902,1/18/20221

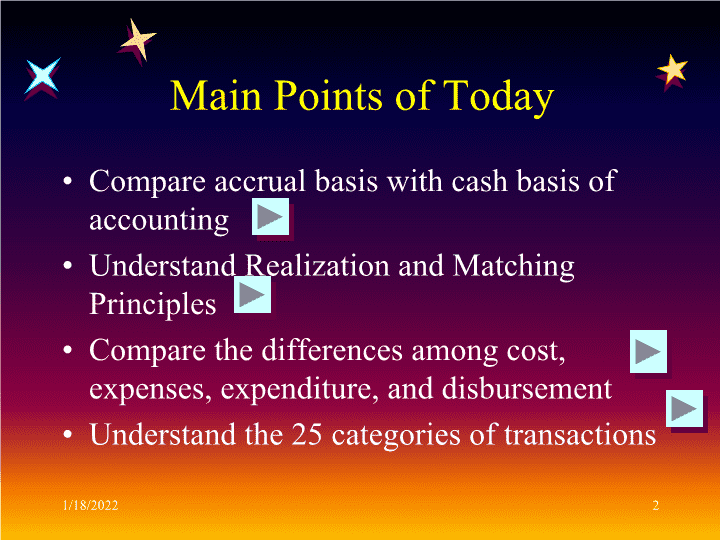

MainPointsofTodayCompareaccrualbasiswithcashbasisofaccountingUnderstandRealizationandMatchingPrinciplesComparethedifferencesamongcost,expenses,expenditure,anddisbursementUnderstandthe25categoriesoftransactions1/18/20222

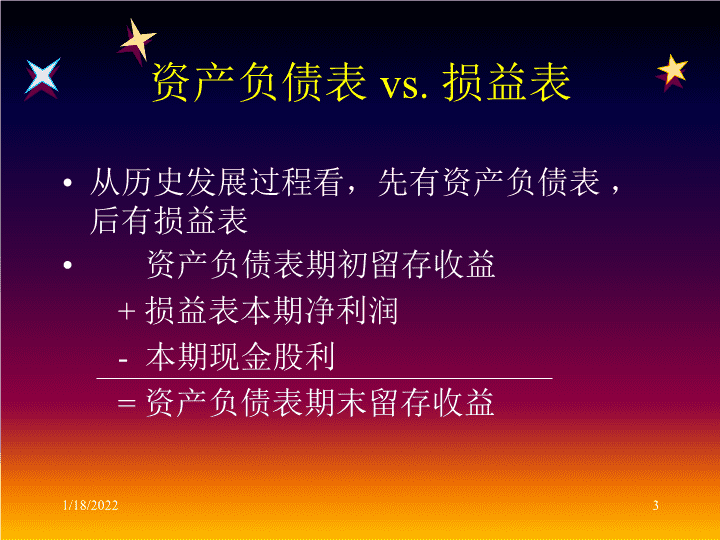

资产负债表vs.损益表从历史发展过程看,先有资产负债表,后有损益表资产负债表期初留存收益+损益表本期净利润-本期现金股利=资产负债表期末留存收益1/18/20223

历史成本原则收入实现—费用配比(权责发生制)稳健性原则会计收益的确定模式1/18/20224

会计恒等式资产负债表与会计恒等式之一:A=L+OE损益表与会计恒等式之二:Income=Revenue收入–Expense费用收益Income=盈余Earning=利润Profit1/18/20225

WhatisNetIncome?Netincomeisnotanassetit’sanincreaseinownersequityfromprofitsofthebusiness.A=L+OEIncreaseDecreaseIncreaseEither(orboth)oftheseeffectsoccurasnetincomeisearned......butthisiswhatnetincomereallymeans.1/18/20226

RevenueandExpensesThepriceforgoodssoldandservicesrenderedduringagivenaccountingperiod.Increasesownersequity.Thecostsofgoodsandservicesusedupintheprocessofearningrevenue.Decreasesownersequity.1/18/20227

A=L+OEASSETSDebitforIncreaseCreditforDecreaseEQUITIESDebitforDecreaseCreditforIncreaseLIABILITIESDebitforDecreaseCreditforIncrease复式簿记借贷规则

DebitandCreditRules借和贷失去了原来的涵义!1/18/20228

DebitsandCreditsforRevenueandExpenseEQUITIESDebitforDecreaseCreditforIncreaseREVENUESDebitforDecreaseCreditforIncreaseEXPENSESCreditforDecreaseDebitforIncreaseExpensesdecreaseownersequity.Revenuesincreaseownersequity.1/18/20229

持续经营会计分期在各期分配利润现金收付制收入实现原则费用配比原则权责发生制1/18/202210

权责发生制与收付实现制收付实现制CashBasis:也称现金收付制,是以现金的收到或支付作为确认收入和费用的依据。(实收实付)权责发生制Accrualbasis:也叫应计制会计。凡是当期已经实现的收入和已经发生或应当负担的费用,不论款项是否收付,都应当作为当期的收入和费用;凡是不属于当期的收入和费用,即使款项已在当期收付,也不应当作为当期的收入和费用。(应收应付)1/18/202211

特点:Accrualbasis计算繁杂、盈亏计算合理准确、但是易操纵利润;Cashbasis核算手续简单,有利于真实揭示企业的现金流动情况,但是不能真实反映经营成果。适用范围:Accrualbasis企业等计算盈亏的单位;Cashbasis政府机关。Accrualbasis&cashbasis1/18/202212

EntriestoApportionUnrecordedCosts分配未记成本和费用EntriestoRecordUnrecordedExpensesEntriestoApportionUnearnedRevenue分配未记的收入EntriestoRecordUnrecordedRevenueTypesofAdjustingEntries1/18/202213

EntriestoApportionUnrecordedCostsPriorPeriodsCurrentPeriodFuturePeriodsTransactionPaidfutureexpensesinadvance(createsanasset).EndofCurrentPeriodAdjustingEntryRecognizeportionofassetconsumedasexpense,andReducebalanceofassetaccount.1/18/202214

EntriestoApportionUnrecordedCostsExamplesInclude:DepreciationSuppliesExpiringInsurancePolicies1/18/202215

EntriestoApportionUnearnedRevenuePriorPeriodsCurrentPeriodFuturePeriodsTransactionCollectedfromcustomersinadvance(createsaliability).EndofCurrentPeriodAdjustingEntryRecognizeportionearnedasrevenue,andReducebalanceofliabilityaccount.1/18/202216

EntriestoApportionUnearnedRevenueExamplesInclude:AirlineTicketSalesSportsTeams?SalesofSeasonTickets1/18/202217

EntriestoRecordUnrecordedExpensesPriorPeriodsCurrentPeriodFuturePeriodsTransactionLiabilitywillbepaid.EndofCurrentPeriodAdjustingEntryRecognizeexpenseincurred,andRecordliabilityforfuturepayment.1/18/202218

EntriestoRecordUnrecordedExpensesExamplesInclude:InterestWagesandSalariesPropertyTaxesHey,whendowegetpaid?1/18/202219

EntriestoRecordUnrecordedRevenuePriorPeriodsCurrentPeriodFuturePeriodsTransactionReceivablewillbecollected.EndofCurrentPeriodAdjustingEntryRecognizerevenueearnedbutnotyetrecorded,andRecordreceivable.1/18/202220

EntriestoRecordUnrecordedRevenueExamplesInclude:InterestEarnedWorkCompletedButNotYetBilledtoCustomer1/18/202221

ArgentiCo.commencedoperationsonJan.1,year5.Thefirm’scashaccountrevealedthefollowingtransactionsforthemonthofJanuary:CashReceipts:Jan.1InvestmentbyArgentifor100%commonstock$50,000Jan.1LoanfromNo.1Bank,dueJune30,Year6,interestrate6%,20,000Jan.5AdvancepaymentfromacustomerformerchandisescheduledfordeliveryonFeb.800Jan.1-31Salestocustomers40,000CashDisbursementJan.1Rentalofretailspaceatamonthlyrentalof$2,500(5,000)Jan.1Purchaseofdisplayequipment(5yrlife,0salvagevalue)(30,000)Jan.1PremiumonpropertyinsuranceforcoveragefromJan.1toDec.31,Yr6(2,400)Jan.15Paymentofutilitybills(2,250)Jan.16Paymentofsalaries(850)Jan.1-31Purchaseofmerchandise(34,900)Balance,Jan.31,Yr6$35,400EXAMPLE1/18/202222

EXAMPLEThefollowinginformationrelatestoArgentiCo.asofJan.31,Yr6:.Customersowethefirm$7,500fromsalesmadeduringJanuary..Thefirmowessuppliers$4,400formerchandisepurchasedduringJanuary..Unpaidutilitybillstotal$760andunpaidsalariestotal$2,590..Merchandiseinventoryonhandtotals$7,200.Question:PleasecalculatetheincomeofJanuary,Year5.1/18/202223

solutionaccrualbasiscashbasisSalesrev.$47500$40800Lessexpenses:costofmerchandisesold$32100paymentsonmerchandisepurchased$34900depreciationexpense500paymentsonequipmentpurchased30000utilitiesexpense1610850salariesexpense48402250Rentexpense25005000insuranceexpense2002400Interestexpense1000Totalexpense$(41850)$(75400)Netincome$5650$(34600)1/18/202224

TheRealizationPrinciple:

WhenToRecordRevenueRealizationPrincipleRevenueshouldberecognizedatthetimegoodsaresoldandservicesarerendered.例:预收货款业务、现金销售业务、赊销业务、分期付款业务1/18/202225

收入确认的金额例:P48赊销收入是$100000,坏账率3%,本期应确认多少收入?对报表有何影响?解一:借:应收账款97000贷:主营业务收入97000解二:借:应收账款100000贷:主营业务收入100000借:管理费用3000贷:坏账准备30001/18/202226

TheMatchingPrinciple:

WhenToRecordExpensesMatchingPrincipleExpensesshouldberecordedintheperiodinwhichtheyareusedup.例:预付货款采购、现金采购、赊购、折旧、计提坏账准备等等。1/18/202227

配比原则

MatchingandCostRecovery因果配比(直接配比):收入与其对应的成本配比,如:主营业务收入与主营业务成本,其他业务收入与其他业务成本配比。时间配比(期间成本):一定时期的收入与同时期的费用相配比,如:当期的收入与管理费用、财务费用等期间费用相配比。与未来收入不直接相关的费用计入当期费用。如:资产减值、意外损失等。1/18/202228

费用expenses、成本costs、

支出expenditures、开支disbursement费用、成本与权责发生制联系,体现在损益表中开支与现金收付制联系,体现在现金流量表中,包括经营性、投资性、筹资性现金流出支出=商品和服务的采购金额支出=资本性支出+收益性支出表现:资产的减少、负债的增加、资产的变化费用成本期间费用料+工+费销售费用、管理费用、财务费用1/18/202229

支出与费用此项支出的受益期间不仅限于本期吗?资产账户XXYYZZ留存收益XXYYZZ现金或应付项目XX支出已发生成本YN资本化费用摊销分录1/18/202230

划分收益性支出和资本性支出

Revenueexpenditures&Capitalexpenditures定义:收益期<1年/1营业周期收益性支出收益期>1年/1营业周期资本性支出会计处理:收益性支出记入当期费用;资本性支出先记为资产,后按受益期分期记入费用划分错误的后果当期资产费用利润以后资产费用利润RE~CE+-+++-CE~RE解释P53图3-31/18/202231

案例:WorldComInc.背景:手段1/18/202232

收入费用净收益资产交易、事项和情况传统收益确定的特点历史成本原则折旧摊销配比原则实现原则资料来源:PatonandLittleton,《公司会计准则绪论》1/18/202233

Depreciation折旧Depreciationisthesystematicallocationofthecostofadepreciableassettoexpense.Depreciableassetsarephysicalobjectsthatretaintheirsizeandshapebutlosetheireconomicusefulnessovertime.1/18/202234

TheConceptofDepreciationTheportionofanassetsutilitythatisusedupmustbeexpensedintheperiodused.Cash(credit)FixedAsset(debit)Ondatewheninitialpaymentismade...Theassetsusefulnessispartiallyconsumedduringtheperiod.Atendofperiod...AccumulatedDepreciation(credit)DepreciationExpense(debit)1/18/202235

Let’spreparetheIncomeStatementforJJ’sLawnCareServiceforthemonthendingMay31,2001.Anexample:JJ’sLawnCareService1/18/202236

InvestmentsandwithdrawalsbytheownerarenotincludedontheIncomeStatement.1/18/202237

DepreciationIsOnlyanEstimateOnMay2,2001,JJsLawnCareServicepurchasedalawnmowerwithausefullifeof50monthsfor$2,500cash.Usingthestraight-linemethod,calculatethemonthlydepreciationexpense.$2,50050=$50DepreciationExpense(perperiod)=CostoftheassetEstimatedusefullife1/18/202238

DepreciationIsOnlyanEstimateJJsLawnCareServicewouldmakethefollowingadjustingentry.Contra-asset1/18/202239

DepreciationIsOnlyanEstimateJJs$15,000truckisdepreciatedover60monthsasfollows:$15,00060months=$250permonth1/18/202240

Accumulateddepreciationwouldappearonthebalancesheetasfollows:1/18/202241

Afterthesetwoadjustingentriesaremade,JJ’sAdjustedTrialBalancelookslikethis.Next,letspreparetheIncomeStatementforJJsLawnCareServiceforMay.1/18/202242

1/18/202243

会计核算原则重要性惯例Materialityconcept一贯性原则Consistencyprinciple实质重于形式原则充分披露原则Fulldisclosureprinciple1/18/202244

会计事项及其类型AccountingEventsandTheirCategories会计事项(AccountingEvents)定义引起会计恒等式的基本构成要素发生变动的交易或事项类型(25种)资产增加负债减少所有者权益减少收入减少费用增加资产减少负债增加所有者权益增加收入增加费用减少1/18/202245

25种会计事项的记录方法25种会计事项的记录方法TransactionsIdentifyAccounts+or-DrorCrJournalEntryType1.收回客户赊欠货款10000CashAccountsReceivable+-DrCr现金10000应收账款10000Type2.用长期借款偿还货款50000AccountsPayableLong-ternLoansPayable-+DrCr应付账款50000长期借款50000Type3.提取法定盈余公积20000UndistributedProfitStatutorySurplusReserve-+DrCr未分配利润20000盈余公积200001/18/202246

25种会计事项的记录方法25种会计事项的记录方法TransactionsIdentifyAccounts+or-DrorCrJournalEntryType4.更正误记的边角料收入8000MajorOperatingRevenueOtherOperatingRevenue-+DrCr主营业务收入8000其他业务收入8000Type5.更正误记为销售费用的管理费用1200GeneralandAdministrativeExpensesSalesExpenses+-DrCr管理费用1200销售费用1200Type6.赊购库存商品20000InventoriesAccountsPayable++DrCr存货20000应付账款200001/18/202247

25种会计事项的记录方法25种会计事项的记录方法TransactionsIdentifyAccounts+or-DrorCrJournalEntryType7.所有者投入货币资金50000作为出资BankDepositsPaid-inCapital++DrCr银行存款50000实收资本50000Type8.赊销库存商品30000AccountsReceivableMajorOperatingRevenue++DrCr应收账款30000主营业务收入30000Type9.更正多付的利息支出2400BankDepositsFinancialExpenses+-DrCr银行存款2400财务费用24001/18/202248

25种会计事项的记录方法25种会计事项的记录方法TransactionsIdentifyAccounts+or-DrorCrJournalEntryType10.用银行存款偿还长期借款30000Long-termLoansPayableBankDeposits--DrCr长期借款30000银行存款30000Type11.债权人将10000转为对本企业的投资AccountsPayablePaid-inCapital-+DrCr应付账款10000实收资本10000Type12.向客户发出其订购的一部分商品15000万元,该客户已预付全部货款AdvancesfromCustomersMajorOperatingRevenue-+DrCr预收账款15000主营业务收入150001/18/202249

25种会计事项的记录方法25种会计事项的记录方法TransactionsIdentifyAccounts+or-DrorCrJournalEntryType13.冲回多提的应付销售人员工资11000AccruedPayrollSalesExpenses--DrCr应付工资11000销售费用11000Type14.向所有者支付现金股利12000UndistributedProfitsBankDeposits--DrCr未分配利润12000银行存款12000Type15.宣布发放现金股利8000UndistributedProfitsDividendsPayable-+DrCr未分配利润8000应付股利80001/18/202250

25种会计事项的记录方法25种会计事项的记录方法TransactionsIdentifyAccounts+or-DrorCrJournalEntryType16.向所有者销售商品5000,货款用未分配利润抵扣UndistributedProfitsMajorOperatingRevenue-+DrCr未分配利润5000主营业务收入5000Type17.本期已入账的保险费1000应由所有者承担,并由未分配利润抵扣UndistributedProfitsGeneralandAdministrativeExpenses--DrCr未分配利润12000管理费用12000Type18.退还多收客户的货款6000MajorOperatingRevenueBankDeposits--DrCr主营业务收入6000银行存款60001/18/202251

25种会计事项的记录方法25种会计事项的记录方法TransactionsIdentifyAccounts+or-DrorCrJournalEntryType19.将多收的货款作为预收账款7000MajorOperatingRevenueAdvancesfromCustomers-+DrCr主营业务收入7000预收账款7000Type20.更正向所有者销售并用未分配利润抵扣的多计款1000MajorOperatingRevenueUndistributedProfits-+DrCr主营业务收入1000未分配利润1000Type21.企业向客户销售商品多计3000,客户也向企业多收广告费用3000,经协商予以抵销。MajorOperatingRevenueSalesExpenses--DrCr主营业务收入3000销售费用30001/18/202252

EndofChapter3作业:P62习题3-1案例:P67案例3-4Pinetree汽车旅馆1/18/202253'