- 1.21 MB

- 2022-04-29 14:47:55 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

'IncomeStatement(损益表)Revenues(销售收入)Costofgoodssold(COGS)(产品销售成本)=GrossProfit(毛利润)Expenses(费用)=EarningsBeforeTax(税前收益)Tax(所得税)=NetIncome(净收益)Thepurposeoffirmistoearnincomeforinvestorsthroughsellinggoodsorprovidingservicestocustomers.Incomestatementmeasureshowmuchincomeisearnedduringaspecificperiod,suchasayear,aquarter,oramonth.

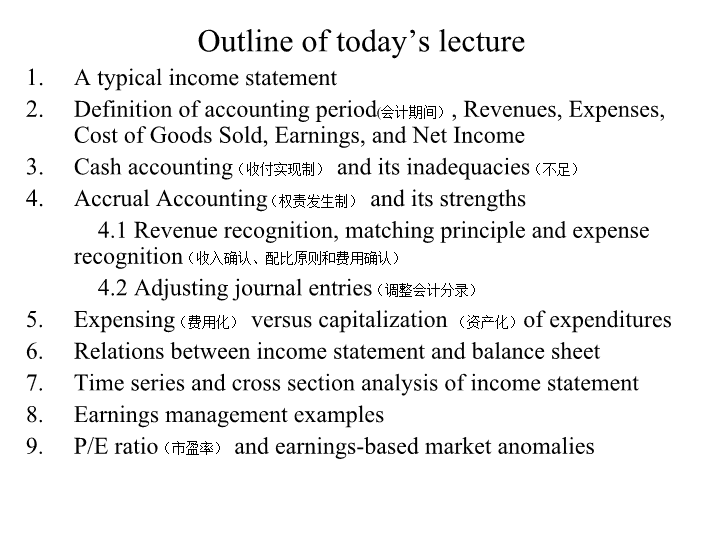

Outlineoftoday’slectureAtypicalincomestatementDefinitionofaccountingperiod(会计期间),Revenues,Expenses,CostofGoodsSold,Earnings,andNetIncomeCashaccounting(收付实现制)anditsinadequacies(不足)AccrualAccounting(权责发生制)anditsstrengths4.1Revenuerecognition,matchingprincipleandexpenserecognition(收入确认、配比原则和费用确认)4.2Adjustingjournalentries(调整会计分录)5.Expensing(费用化)versuscapitalization(资产化)ofexpenditures6.Relationsbetweenincomestatementandbalancesheet7.Timeseriesandcrosssectionanalysisofincomestatement8.Earningsmanagementexamples9.P/Eratio(市盈率)andearnings-basedmarketanomalies

DefinitionsRevenueRevenuesareinflowsofnetassets(assetslessliabilities)fromsellinggoodsorprovidingservicesGain/LossSometimesafirmengagesinunusual,non-operatingactivitiesandmakesorlosessomemoney.Assetsinflows/outflowsasaresultofsuchactivitiesarecalledgainsorlosses.ExpensesExpensesmeasuresthenetassetsthatafirmconsumesintheprocessofgeneratingrevenuesCostofGoodsSoldIfafirmbuyandsell,orproduceandsell,products,thenetassetsthatdirectlygointotheproductssold,arecalledcostofgoodssold.NetIncomeAlsocalledbottomline,itisthedifferencebetweenallrevenuesandgains,andallcostsofgoods,expensesandlosses.EarningsOnincomestatement,beforewereachbottomlinenetincome,someintermediarysumsarecalledearnings,suchasearningsfromcontinuingoperation.

Ledger(T-Account)treatmentofincomestatementaccountsRevenuesGainsExpenses(inc.COGS)LossDividends

CashAccountingRevenues:recognizedatthetimethatcashisreceivedExpenses:recognizedatthetimethatcashisdisbursedNote:Cashreceivedfromanddisbursed(分发)toshareholdersandcreditors(债权人)isneitherrevenuesnorexpenses,anddoesnotenterincomestatementundercashaccountingAnexample:AtoyretailerstartsbusinessonNovember1,19x0,Hepaystwomonthsrentonhisstore,$2,000,onthatday,andalsopurchasesandpayfor$35,000toys.However,hesellsnothinginNovember.InDecember,hesellsallthetoyswithasalespriceof$40,000andcollects$5,000incash

CashAccountingIncomeStatementNovemberDecemberRevenues$0$5,000LessExpensesandCOGS:CostofGoodsSold35,0000Rentalexpense2,0000NetIncome($37,000)$5,000

ProblemswithCashAccountingMismatchthecostofefforts(expenses)withtheoutputoftheefforts(revenues)DelayrecognitionofrevenuesProvideopportunitiestomanageearnings

AccrualAccountingRevenuerecognition:followrealizationprinciple(实现原则)1)Afirmhasperformedall,ormostof,theservicesitexpectstoprovide2)Thefirmhasreceivedcashorsomeotherassetscapableofreasonablyprecisemeasurement,suchasaccountreceivables

AccrualAccountingExpenserecognition:Whenanassetisuseddirectlytogeneraterevenues,theusedassetbecomesexpense.E.g.,Amazon.comsoldbooks,thecosttopurchasethesoldbooksbecomeCOGS,apartofexpenses.Thisiscalledmatchingprinciple(配比原则)ofaccounting.Whenanusedassetisindirectlyrelatedtothecurrent,andonlythecurrent,periodrevenues,wetreattheusedassetasexpense.E.g.,cashtopayforadvertisement,salaryfortheCEO.Whenanassetisusedtobenefitboththecurrentandthefutureperiod,thebenefit,nevertheless,notmattercurrentorfuture,ishardtoidentifyandmeasure,wetreattheusedassetasexpense.E.g.,cashusedtopayresearchanddevelopmentforpharmaceuticalcompanies.Thisisconservativeprinciple(稳健原则)ofaccounting.

AccrualAccountingIncomeStatementNovemberDecemberRevenues$0$40,000LessExpensesandCOGS:CostofGoodsSold035,000Rentalexpense1,0001,000NetIncome(1,000)4,000

AdjustingJournalEntriesUnderAccrualAccountingUnderaccrualaccounting,somejournalentriesarenotexplicitlyrelatedtoatransaction.Wemaketheseentries,adjustingjournalentries,mostlikelyattheendofanaccountingperiod.Therearefourtypesofadjustingentries:Unearnedrevenue(客户预付款)AccruedRevenue(应计收入)Prepaidexpense(预付费用)Accruedexpense(应计费用)

UnearnedRevenueExample:SupposeyouaretheaccountantofGuanghuaandGuanghua’spolicyistoproportionatelyreturnstudenttuitionswheneverastudentchoosestoquitschool(notabadact,BillGatesquittedHarvard).SoonSeptember1,2002,youpaid$80,000toGuanghuafortwo-yeartuitions.Receivecashrecognizerevenue

UnearnedRevenueOnSep.1,2002,althoughGuanghuareceivedthecash,toit,thecashreceivedisunearnedrevenue.Thatis,Guanghuahasnotprovidedyoueducationalserviceyet.Guanghua’sjournalentry:Dr.Cash$80,000Cr.UnearnedRevenue(liability)$80,000OnDec.31,2002,afteryouhavespenthalfayearatGuanghuatoenjoyitssuperbservice,Guanghuahasearnedone-fourthofthetuitions.Journalentry:Dr.UnearnedRevenue$20,000Cr.Revenue$20,000

AccruedRevenueExample:IfyouareamanufactureofcarsandIboughtacarfromyouonNov.12,2002for$3,000,butweagreethatIpayyounextyear.YouhaveearnedthemoneybecauseItookthecar.Butyouhavenotreceivedthecash.Still,itisyourmoneyandyourrevenue.Dr.AccountReceivable$3,000Cr.Revenue$3,000RecognizerevenueReceivecash

PrepaidexpenseExample,backtotheGuanghuacase,fromyourpointofview,the$80,000isprepaidexpense.Thatis,ifonSep.2,2002,youwanttoquitschool,youwillgetmoneyback(ifyouwanttotrythis,pleasedosobeforeoraftermycourse).Thatis,youstillownthemoney.Paycashrecognizeexpense

PrepaidexpenseOnSep.1,2002,youraccount:Dr.Prepaidtuitions$80,000Cr.Cash$80,000OnDec.31,2002,youDr.Tuitionexpense$20,000Cr.Prepaidexpense$20,000Ifyouquitschoolonthisday,youget$60,000backfromtheschool.

AccruedExpenseExample,youworkedforyourcompanyinDecember2002,andyourcompanywillpayyoursalaryof$3,000ofDecemberinJanuary2003.Buttothecompany,expensehasincurredin2002,althoughcashisnotpaidinDecemberof2002.SothecompanyDr.Expense$3,000Cr.Salarypayable$3,000recognizeexpensepaycash

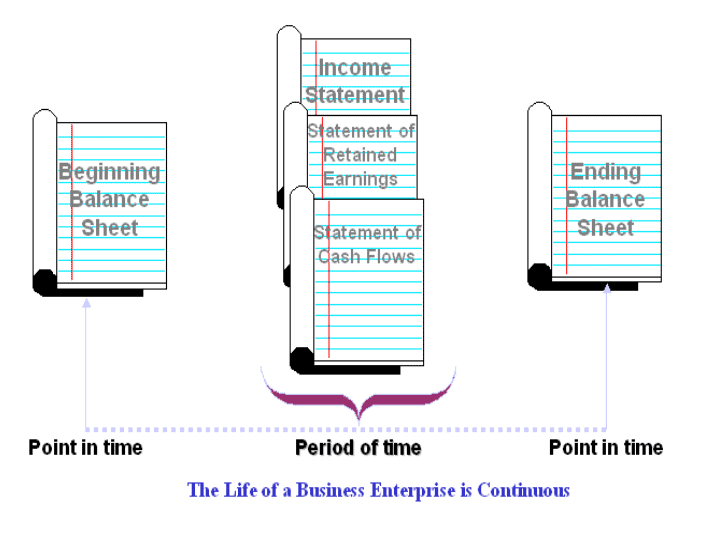

TheFinalStagesoftheAccountingProcess(refertoapremieronaccountinghandout)OnDec.31oftheyear,theaccountantsfinishedalljournalentries,postedtoledger(T-accounts),calculatedthebalance(余额)ofeveryledgeraccount,anddidatrialbalance.Nowshe/hedoesadjustedjournalentries,andthenpoststoledgeragain,anddoesanadjustedtrialbalance.Whatshe/hehasinhandsnowisalistofaccounts.Next:PrepareincomestatementCloseincomestatementaccountstoretainedearningsaccountPreparebalancesheetQ.E.D

Expensingvs.CapitalizationofExpendituresAfirmpaysemployeesalaries,wesaythefirmexpenseemployeesalaryExpensedexpendituresgotoincomestatementExpensedexpenditureshelpgeneraterevenuesincurrentperiodIfafirmexpensestheexpenditure,currentearningswillbelowerbythatamountAfirmbuyabuilding,wesaythefirmcapitalizethebuildingasasset.CapitalizedexpendituresgotobalancesheetCapitalizedexpenditureshelpgeneraterevenuesincurrentandfutureperiodsIfafirmcapitalizestheexpenditure,currentearningswillnotbeloweredbythatamount

Expensingvs.CapitalizationofExpendituresButlifeisnotsosimpleandstraightforward.Sometimesitisdifficulttodeterminewhethertheexpendituresbenefitfutureperiods,andifitbenefitsfutureperiods,itisdifficulttodeterminewhichfutureperiodwillbenefit.Therefore,firmsexpensesomeexpendituresthatmayotherwisebecapitalized.ThisisaconservativetreatmentoftheexpendituresbyGAAP.MarketingexpendituresResearchandDevelopmentStockoptions

TheWorldcomscandalJune26,2002,Worldcomreportsitoverstatedearningsby$3.8billioninthepastfewyears.Itquicklyaskedforchapter11protectionWhatdidtheydo?Capitalizeexpendituresthatshouldhavebeenexpensed.Thatis,$3.8billionshouldnotbeonbalancesheet,butgothroughincomestatementasexpense.In2001,thecompanyreportsearningsof1.4billion,whichshouldhavebeenalossyear.

TherelationbetweenbalancesheetandincomestatementAssets=Liabilities+EquityEquity=Contributedcapital(股本)+RetainedEarnings(RE)Ending(期末余额)RE=Beginning(期初余额)RE+NetIncome–DividendsNetIncome=Revenues–ExpensesA=L+Contributedcapital+BeginningRE+(Revenues–Expenses)–DividendsTherefore,revenuesincreaseassetsandequityexpensesdecreasesassetsandequity

TimeSeriesanalysisofcommon-sizeincomestatement

Crosssectionanalysis(横向分析)ofcommon-sizeincomestatement

Growthanalysisofincomestatement

AfewitemsonI/SexplainedCostofrevenues=Costofgoodssold(COGS)SalesandMarketingSelling,generalandadministrativeProductdevelopmentDepreciationandamortizationOperatingincomeorincomefromoperationExtraordinaryitem:unusualandinfrequentNetIncomeEarningspershare-primaryEarningspershare-dilutedEarningspershare-endofyearnumberofshares,oraveragenumberofshares?ProFormaearnings=Asifearnings

AOL2000

AOL2000

EarningsManagement-WhyFormanagers:earnings-basedbonusForshareholders:earnings-basedbondcovenantForthecompany:BetterIPOprice(新股上市发行价)AvoidgovernmentregulationAvoidpayingemployeehighsalaries

EarningsManagement-HowAccelerateordelayrevenuesAccelerateordelayexpensesTakeone-timegainsorcharges:bigbath

Earningsmanagement–Whogain,wholose?EnroncaseWorldcomcase

Price-to-earningsratio–P/EP/EisareadyyardstickforvaluationUsecomparablefirms’P/EtopriceIPOstocksP/Eisaroughindicatorofrelativeover-valuationorunder-valuationAverageP/Eratioofallstocksonamarketindicatesthelevelofvaluationofthemarket

P/EanomalyHighP/Estocks(glamourstocks,growthstocks)earnlowerreturnintheone-year-aheadperiod;lowP/Estocks(valuestocks)earnhigherstockreturnsinthesameperiod.Thereturndifferentialisnotexplainedbyrisk.FamaandFrenchJournalofFinance1992,thenumbersaremonthlyreturninpercentageHighP/E23456789LowP/E0.930.941.031.181.221.331.421.461.471.74

Caveats(提醒)inusingP/EinvaluationNegativeearningscannotbeusedincomputingP/EEarningscontaintransitory(临时的)items,orone-timeitemsthatdriveP/EupordowntemporarilyP/Eratioismeaningfulonlywhenearningscomefromnormal,repetitiveoperationIninvestingcommunity,peopleusedifferentearningstocomputeP/E,lagearnings,leadearnings,averageearnings…

InvestingMotto“FinancialStatementislikebikini,whatitrevealsisinteresting,butwhatitconcealsitvital.”BurtonG.Malkiel'

您可能关注的文档

- 资产负债表与损益表(doc 3页).doc

- 资产负债表与损益表操作步骤.doc

- 【财务表格】预计损益表(表十七).doc

- 房地产预计损益表.doc

- 酒店营运损益表.doc

- 物流企业管理 第2版 教学课件 作者 刘五平 伍玉坤物流企业管理电子教案及试题答案第09章 损益表(的附件).doc

- 旅游社经营管理 教学课件 作者 吴敏良 杨强第八章 损益表.doc

- xx物流有限公司财务部报表管理系统——损益表.doc

- 损益表及交叉检验.ppt

- 完整中英文对照资产负债表_损益表__现金流量表mark.doc

- 公司损益表与资产负债表讲义.ppt

- 损益表格式及各项目的含义和计算.ppt

- xx物流有限公司财务部报表管理系统——月损益表.doc

- 杭州知名的广告公司利润中心损益表.doc

- 损益表反映的财务管理内容.ppt

- 财务分析 2 损益表.doc

- 会计实务操作(资产负债、损益表格).doc

- 完整资产负债表格和损益表格.doc