- 28.77 KB

- 2022-04-29 14:47:59 发布

- 1、本文档共5页,可阅读全部内容。

- 2、本文档内容版权归属内容提供方,所产生的收益全部归内容提供方所有。如果您对本文有版权争议,可选择认领,认领后既往收益都归您。

- 3、本文档由用户上传,本站不保证质量和数量令人满意,可能有诸多瑕疵,付费之前,请仔细先通过免费阅读内容等途径辨别内容交易风险。如存在严重挂羊头卖狗肉之情形,可联系本站下载客服投诉处理。

- 文档侵权举报电话:19940600175。

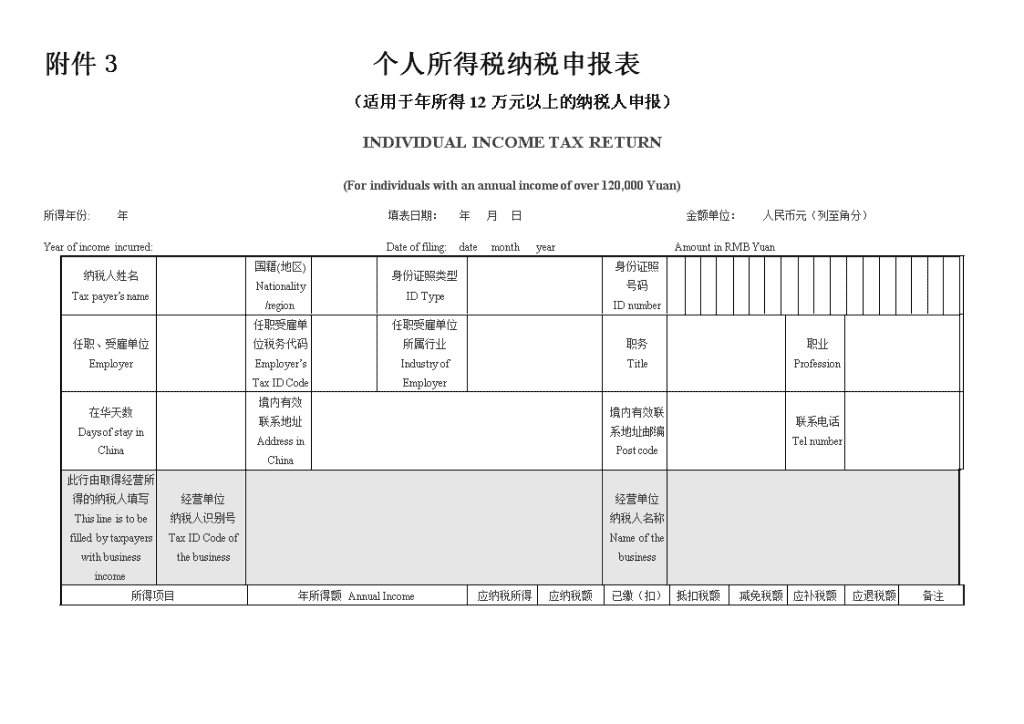

'附件3个人所得税纳税申报表(适用于年所得12万元以上的纳税人申报)INDIVIDUALINCOMETAXRETURN(Forindividualswithanannualincomeofover120,000Yuan)所得年份: 年 填表日期: 年 月 日 金额单位: 人民币元(列至角分)Yearofincomeincurred: Dateoffiling: date month year AmountinRMBYuan纳税人姓名Taxpayer’sname 国籍(地区)Nationality/region 身份证照类型IDType 身份证照号码IDnumber 任职、受雇单位Employer 任职受雇单位税务代码Employer’sTaxIDCode 任职受雇单位所属行业IndustryofEmployer 职务Title 职业Profession 在华天数DaysofstayinChina 境内有效联系地址AddressinChina 境内有效联系地址邮编Postcode 联系电话Telnumber 此行由取得经营所得的纳税人填写Thislineistobefilledbytaxpayerswithbusinessincome经营单位纳税人识别号TaxIDCodeofthebusiness 经营单位纳税人名称Nameofthebusiness 所得项目年所得额 AnnualIncome应纳税额抵扣税额减免税额应补税额应退税额备注

Categoriesofincome应纳税所得额TaxableincomeTaxpayable已缴(扣)税额Taxpre-paidandwithheldTaxcreditTaxexemptedordeductedTaxowedTaxrefundableNotes境内IncomefromwithinChina境外IncomefromoutsideChina合计Total1、工资、薪金所得 Wagesandsalaries 2、个体工商户的生产、经营所得 Incomefromproductionorbusinessoperationconductedbyself-employedindustrialandcommercialhouseholds 3、对企事业单位的承包经营、承租经营所得Incomefromcontractedorleasedoperationofenterprisesorsocialserviceproviderspartlyorwhollyfundedbystateassets 4、劳务报酬所得Remunerationforprovidingservices 5、稿酬所得Author’sremuneration 6、特许权使用费所得Royalties 7、利息、股息、红利所得Interest,dividendsandbonuses 8、财产租赁所得Incomefromleaseofproperty 9、财产转让所得Incomefromtransferofproperty 其中:股票转让所得Incomefromtransferofstocks ——————— 个人房屋转让所得Incomefromtransferofpersonalestate 10、偶然所得Incidentalincome

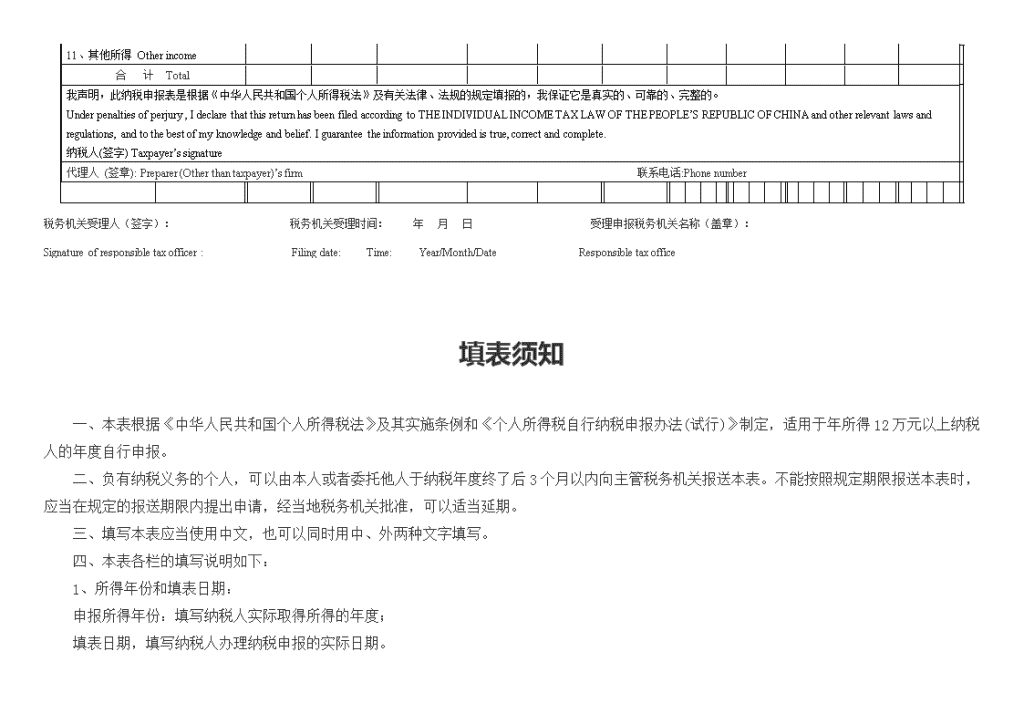

11、其他所得Otherincome 合 计 Total 我声明,此纳税申报表是根据《中华人民共和国个人所得税法》及有关法律、法规的规定填报的,我保证它是真实的、可靠的、完整的。Underpenaltiesofperjury,IdeclarethatthisreturnhasbeenfiledaccordingtoTHEINDIVIDUALINCOMETAXLAWOFTHEPEOPLE’SREPUBLICOFCHINAandotherrelevantlawsandregulations,andtothebestofmyknowledgeandbelief.Iguaranteetheinformationprovidedistrue,correctandcomplete.纳税人(签字)Taxpayer’ssignature 代理人(签章):Preparer(Otherthantaxpayer)’sfirm 联系电话:Phonenumber 税务机关受理人(签字): 税务机关受理时间: 年 月 日 受理申报税务机关名称(盖章):Signatureofresponsibletaxofficer: Filingdate: Time: Year/Month/Date Responsibletaxoffice填表须知 一、本表根据《中华人民共和国个人所得税法》及其实施条例和《个人所得税自行纳税申报办法(试行)》制定,适用于年所得12万元以上纳税人的年度自行申报。二、负有纳税义务的个人,可以由本人或者委托他人于纳税年度终了后3个月以内向主管税务机关报送本表。不能按照规定期限报送本表时,应当在规定的报送期限内提出申请,经当地税务机关批准,可以适当延期。三、填写本表应当使用中文,也可以同时用中、外两种文字填写。四、本表各栏的填写说明如下:1、所得年份和填表日期:申报所得年份:填写纳税人实际取得所得的年度;填表日期,填写纳税人办理纳税申报的实际日期。

2、身份证照类型:填写纳税人的有效身份证照(居民身份证、军人身份证件、护照、回乡证等)名称。3、身份证照号码:填写中国居民纳税人的有效身份证照上的号码。4、任职、受雇单位:填写纳税人的任职、受雇单位名称。纳税人有多个任职、受雇单位时,填写受理申报的税务机关主管的任职、受雇单位。5、任职、受雇单位税务代码:填写受理申报的任职、受雇单位在税务机关办理税务登记或者扣缴登记的编码。6、任职、受雇单位所属行业:填写受理申报的任职、受雇单位所属的行业。其中,行业应按国民经济行业分类标准填写,一般填至大类。7、职务:填写纳税人在受理申报的任职、受雇单位所担任的职务。8、职业:填写纳税人的主要职业。9、在华天数:由中国境内无住所的纳税人填写在税款所属期内在华实际停留的总天数。10、中国境内有效联系地址:填写纳税人的住址或者有效联系地址。其中,中国有住所的纳税人应填写其经常居住地址。中国境内无住所居民住在公寓、宾馆、饭店的,应当填写公寓、宾馆、饭店名称和房间号码。经常居住地,是指纳税人离开户籍所在地最后连续居住一年以上的地方。11、经营单位纳税人识别码、纳税人名称:纳税人取得的年所得中含个体工商户的生产、经营所得和对企事业单位的承包经营、承租经营所得时填写本栏。纳税人识别码:填写税务登记证号码。纳税人名称:填写个体工商户、个人独资企业、合伙企业名称,或者承包承租经营的企事业单位名称。12、年所得额:

填写在纳税年度内取得相应所得项目的收入总额。年所得额按《个人所得税自行纳税申报办法》的规定计算。各项所得的计算,以人民币为单位。所得以非人民币计算的,按照税法实施条例第四十三条的规定折合成人民币。13、应纳税所得额:填写按照个人所得税有关规定计算的应当缴纳个人所得税的所得额。14、已缴(扣)税额:填写取得该项目所得在中国境内已经缴纳或者扣缴义务人已经扣缴的税款。15、抵扣税额:填写个人所得税法允许抵扣的在中国境外已经缴纳的个人所得税税额。16、减免税额:填写个人所得税法允许减征或免征的个人所得税税额。17、本表为A4横式,一式两联,第一联报税务机关,第二联纳税人留存。 Instructions一、ThisreturnisdesignedinaccordancewithTHEINDIVIDUALINCOMETAXLAWOFTHEPEOPLE’SREPUBLICOFCHINA,THEIMPLEMENTINGRULESOFTHEINDIVIDUALINCOMETAXLAWOFTHEPEOPLE’SREPUBLICOFCHINAandTHERULESCONCERNINGINDIVIDUALINCOMETAXSELFDECLARATION(provisional),andisapplicableforindividualswithanannualincomeofreach120,000Yuan.二、Taxableindividualsareobligedtofilloutandsubmitthereturntothelocaltaxauthoritywithin3monthsaftertheendofthetaxyear,eitherbythemselvesorotherentrustedprepares.Incaseofinabilitytofilethereturnwithintheprescribedtimelimit,anapplicationshouldbesubmittedtothelocaltaxauthoritywithinprescribedtimelimitanduponthetaxauthority’sapproval,thefilingdeadlinemaybeextended.三、ThereturnshouldbefilledoutinChineseorinbothChineseandaforeignlanguage.四、Instructionsforfillingoutvariousitems:1、YearofincomeincurredandDateorfilling:

Yearofincomeincurred:Theyearinwhichthetaxpayerreceivestheincome.Dateorfilling:theactualdatewhenthereturnisfiled.2、IDType:Thenameofthevalididentificationcertificateofthetaxpayer(IDCard,passport,solidercertificate,militaryofficercertificate,returningpermit,etc.)3、IDnumber:Thenumberofthevalididentificationcertificateofthetaxpayer.4、Employer:Thetaxpayer’semployer.Thenameoftheemployerforthereportingshallbefillediftherearemorethanoneemployer.5、Employer’sTaxIDCode:TheIDcodeofthetaxpayer’semployerregisteredattaxauthorityeitherasataxpayerorasawithholder.6、IndustryofEmployer:Theindustryataxpayer’semployerbelongsto.ItshouldfallintothegeneralcategoriesoftheCategorizationofNationalEconomyIndustries.7、Title:Thetaxpayer’sofficialrankathis/heremployer.8、Profession:Themainprofessionofthetaxpayer.9、DaysofstayinChina:TheactualdaysstayedinChinabyataxpayerwithoutapermanentresidenceduringthetaxdueperiod.10、AddressinChina:Theaddressortheeffectivecontactingaddressofthetaxpayer.Forapersonwithoutaresidencewholivesinahotel,itmeanstheroomnumberandhotelname.11、Taxpayer’sTaxIDcoleandTaxpayer’sName:TaxIDCodeofthebusiness:Thenumberonthetaxregistrationcertificate.

Nameofthebusiness:Thenameofthetaxableself-employedindustrialandcommercialhouseholds,individually-investedenterprises,partnerships,individually-investedorpartner-investedprivatenon-enterprises,orenterprisesorsocialserviceproviderspartlyorwhollyfundedbystateassetsundercontractedorleasedoperation.12、AnnualIncome:Thetotalamountofthecorrespondingitemsofincomeinthetaxyear.TheannualreceiptsincomeiscalculatedinaccordancewithTHEINPLEMENTINGRULESOFTHEINDIVIDUALINCOMETAXLAWORTHEPEOPLE’SREPUBLICOFCHINAandTHELAWOFPEOPLE’SREPUBLICOFCHINACONCERNINGADMINISTRATIONOFCOLLECTION.ThecalculationshallbeinRMBYuan.ThoseinforeigncurrenciesshallbeconvertedtotheRMBYuanonthebasisoftheforeignexchangeratequotedbythecompetentstateforeignexchangeauthority.13、Taxableincome:Thepartofanincomewhichissubjecttotheindividualincometax.14、Taxpre-paidandwithheld:TheamountofthetaxpaidorwithheldforthecurrentitemsofincomewithinChina.15、Taxcredit:TheamountofindividualincometaxpaidoutsideChinathatittobecreditedagainstinaccordancewiththeIndividualIncomeTaxLaw.16、Taxexemptedordeducted:TheamountofindividualincometaxwhichistobeexemptedordeductedinaccordancewiththeIndividualIncomeTaxLaw.17、ThereshallbetwooriginalcopiesofthistableinA4format.Oneisforthetaxpayerandtheotherisforthetaxofficeforrecord.'

您可能关注的文档

- 土地增值税纳税申报表(一)

- SB005企业所得税季度纳税申报表

- 城镇土地使用税纳税申报表

- 房产税纳税申报表(汇总版)

- A06110《车船税纳税申报表》

- A06110《车船税纳税申报表》

- 附件 个人所得税纳税申报表

- 消费税纳税申报表

- 烟类应税消费品消费税纳税申报表

- A06443《个人所得税自行纳税申报表(B表)》

- 增值税纳税申报表附列资料(一)

- A06109 房产税纳税申报表

- 房产税纳税申报表(汇总版)

- 在我市启用新纳税申报表工作会议结束时的总结

- A06453《增值税纳税申报表附列资料四(税额抵减情况表)》

- 年所得12万元以上《个人所得税纳税申报表》填表指引

- A06109《房产税纳税申报表》

- 消费税纳税申报表